Smart people know all about credit score, and they understand that this is what determines their ability to get loans, credit cards, and even get jobs and rent houses.

However, if this is the first time you hear about credit score, that’s okay, I have written many different articles about credit score on this website, so take some time and go through them to understand what I shall be talking about.

These are;

- A guide to credit score for college students.

- The three main Credit Bureaus.

- Credit freeze.

- 609 credit repair letter.

Among others….

Have you read? Good. Now let’s dive into Credit Karma and what it’s all about.

A little background information;

It is an excellent habit to regularly review your credit score and credit report, to see how you are faring and most especially to check for errors. You may be surprised to know that 1 in every 5 Americans, or 20% of the US population has found errors on their credit reports, and this adversely affects their credit score.

The Federal Law mandates that everyone should have access to their credit report at least once a year. This should be provided free of charge.

The three main credit bureaus – Equifax, Experian, and TransUnion, are responsible for providing you with your report and score, and to obtain a copy of the report, you must apply through AnnualCreditReport.com.

Now, the problem here is that, with this request, the companies will only share with you the credit report and not the score, and you need the score to figure out whether you qualify for credit or not.

So, the only way to get your score is by purchasing it directly from each of the agencies, and it can be quite expensive.

Where does Credit Karma come in?

Credit Karma, which is a San Francisco based company was founded in 2007, and they came in to shake things up, by offering you FREE access to your credit score and credit report from the three main bureaus. The keyword here is FREE.

This is why most people wonder whether it is real or just a scam. I’m sure you are wondering that too. Well, I will tell you everything you need to know about Credit Karma, and whether it is real or not.

All you need to do is sign up on CreditKarma.com, fill in your details, and guess what! You do not have to register your credit card or provide any payment details as is the case with the three bureaus.

Once you are a registered member, you can be able to keep track of your credit score for free. They continuously keep updating it, and in addition to that, they will give you tips and ideas on how to make your credit score better, in case there are some issues.

These tips include bill payment options, improving your on-time payments and credit card utilization, among others.

Credit Karma: – In-depth Review

So, as mentioned above, Credit Karma offers you free access to your credit report and score all year round.

The question on your mind right now must be, “why is it free?” and “is it worth it?”

I will answer you;

The reason why Credit Karma has made these services free of charge is because they have made Transparency central as their main business model, and their main aim is to demystify credit for the ordinary or average person. This means that they are making it easy for you to understand and ensure that you do not get duped or conned by unscrupulous individuals who are out to get your money.

Therefore, it is absolutely worth it! Most people I spoke with have been using Credit Karma for years, and they always give them the right information, which helps them make the right decisions concerning their creditworthiness.

What is their central belief?

The company’s central belief is that customers should have free access to their data because after all the information on your credit report is yours, so, why should you have to pay for it? This data affects almost all areas of your life, and you must be always updated on what is happening to you financially.

They are also on a mission to help consumers understand and build their financial health.

So, how do they make their money?

This is a good question. Credit Karma is not a charity organization, which means that they are for-profit.

According to the company, they make most of their money from tailored and targeted advertisements from financial companies, who advertise their products and services through their website.

One thing I forgot to mention, and one you will probably hate is that; the website has very many ads, which tend to keep popping up whenever you are trying to use it, but, for the free services they offer, this has got to be a small price to pay.

Their business model is designed to produce a win for everyone. You as the consumer, the companies that advertise on their site and of course themselves – Credit Karma. Everybody wins.

As of January 2019, they had more than 85 million customers. This is a marketers dream, and that is why they can offer their services for free, as most companies are more than willing to pay to advertise with them.

They have a strong team that does a robust analysis and use algorithms to identify the most relevant ads for specific people, and as such, the site is in a perfect position to match advertisers with consumers who are likely to appreciate their products.

Credit Karma is actually paid for this lead generation, according to the agreements they have with their advertisers.

Credit Karma Credit Score:

Credit Karma is a website that will help you control your finances. They provide you with a sort of report card, which has a complete overview of your report and score, your credit card guidance, your savings account advice, and other financial aspects of your life.

Unlike other credit reporting sites, you will find two main differences when it comes to Credit Karma;

- They do not have a monthly trial period, or a credit card charge when you sign up. This, as we mentioned earlier, is absolutely free.

- They will give you a credit report card, which outlines your credit categories, reports your inquiries, bankruptcies, and all past due balances. This is based on the data from TransUnion and Equifax.

Now, when you log onto your Credit Karma account, you will be directed to your personal dashboard that shows you your immediate credit summary. This will include the following;

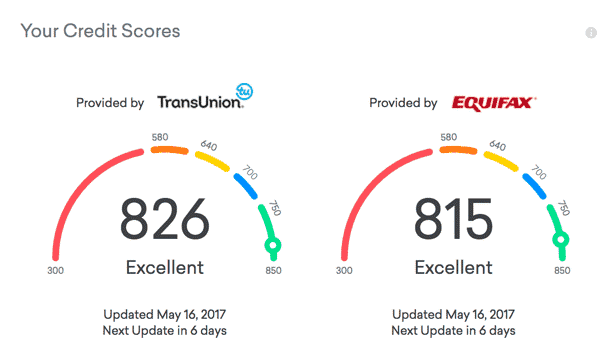

TransUnion and Equifax credit scores:

The credit score you receive is not your FICO score, but your credit score from the two main credit bureaus.

These scores will give you a rough idea of where you stand. You will also be able to see the differences in the information provided by both bureaus and be able to determine the problems you have in your credit report.

Screenshot from the website:

Factors affecting your credit score;

These will include all reported delinquencies, collections, inquiries, the average age of your accounts, and your credit utilization. You will check to see any discrepancies in case there are any, between the information reported on all the credit bureaus.

That is not all. The website has many additional tabs, features, and sections that provide tons of information such as savings, loans, credit, and other financial products you may be interested in, and they will advise you on whether or not you qualify for any of them.

Main features of Credit Karma:

Here is a list of some of the features you shall find on Credit Karma. Some of them I have mentioned before;

TransUnion Credit score:

As mentioned earlier, when you log on to your credit karma page, you shall first see your TransUnion credit score, which is based on the data provided by the TransUnion bureau. This is the Vantage score – if you read the articles I suggested earlier on, you will be able to see this explained.

In addition to this, they will provide you with a history of all the changes to your score over time.

Equifax Credit Score:

Other than the TransUnion credit score, you will also be provided with an Equifax score. Again, this will be based on the data they receive from the Equifax bureau. It is also based on the Vantage score.

Now, do not be alarmed if the Equifax and TransUnion scores are different, because your credit score is based on the information they receive from your creditors. Now, creditors don’t need to send information to the credit bureaus, – It is actually not a must that they do this.

As such, chances are that you shall find that both bureaus have different information, which contributes to different scores. I hope that makes sense to you. If it doesn’t, please have a look at other credit score related blogs that I have listed above because they explain this clearly, and in details.

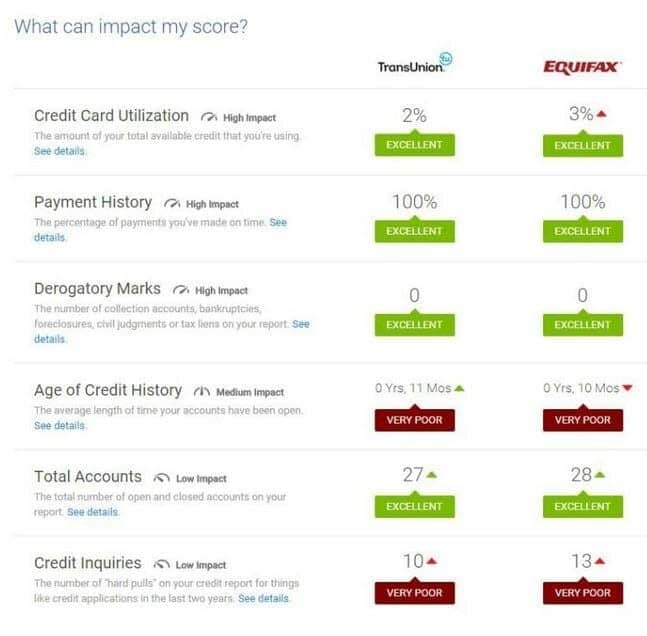

Credit factors:

In addition to the score, you shall receive a list of factors that directly or indirectly hurt your score. These include; your credit card utilization rate, any derogatory remarks from your creditors, your repayment history, the total credit accounts you have, and all credit inquiries you have received.

Credit report:

You shall be able to see the details of your credit report from TransUnion and Equifax. This is provided using a very nice feature on the website. Credit reports from other bureaus usually are in a raw format, which is quite difficult for you to understand, but with Credit Karma, this is simplified and makes it very easy for you to figure out what is going on.

Here is a screenshot from the website

Track your spending;

If you would like to, you can connect your bank accounts and credit cards to your credit karma account. This will help you keep track of your spending, and ensure that you stick to a specific budget that controls overspending.

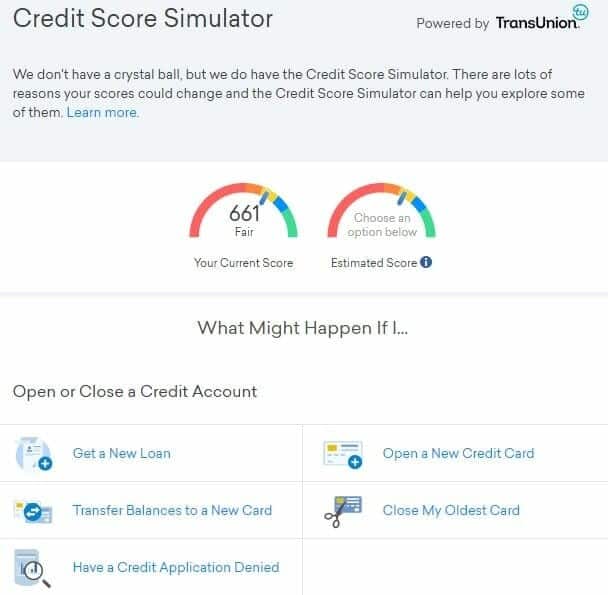

Credit score simulator:

This is a tool that is very helpful in understanding how certain and different activities will affect your credit score. For example, if you are thinking of applying for a new credit card, the credit score simulator will tell you how that will affect your credit score.

It is a handy tool that helps you plan, buy, or refinance your mortgage, and ensures that you do not lower your credit score.

You can simulate all of the following:

- Open a New Credit Card

- Add Credit Inquiries

- Add a New Loan

- Increase your credit limit on one of your cards.

- Increase or decrease your credit balances.

- Pay off all of your credit cards.

- Make only one monthly installment on past due bills.

Screenshot of the credit score simulator

Search for unclaimed money:

This is a brand new feature for Credit Karma, and it helps you search for unclaimed money that may belong to you. This is a state by state search, and it directs you to a specific resource where you can conduct an online search.

Conclusion:

Credit Karma is definitely a website that many people use, mostly since you don’t pay anything to access their services, but, that being said, they have received some not so good reviews in the past from clients.

Some few clients have claimed that the website’s credit score differs from what they find on the Equifax and TransUnion sites, while others say that the information they provide is not always accurate, especially when it comes to the credit score simulator.

What I can say is that it works for some and doesn’t work for others, so, it is up to you to give it a test and check whether it will provide you with the information you are searching for concerning your credit score.

Source: Security Feed